Our proprietary Audit Request Management Software (ARMS) allows you to manage every aspect of your SMSF audits entirely online—securely, efficiently, and with full transparency.

With ARMS, you can:

- Submit and receive audit documentation digitally—no printing, scanning, or manual chasing

- Access an interactive, web-based audit workflow that complies fully with ATO and SIS regulations

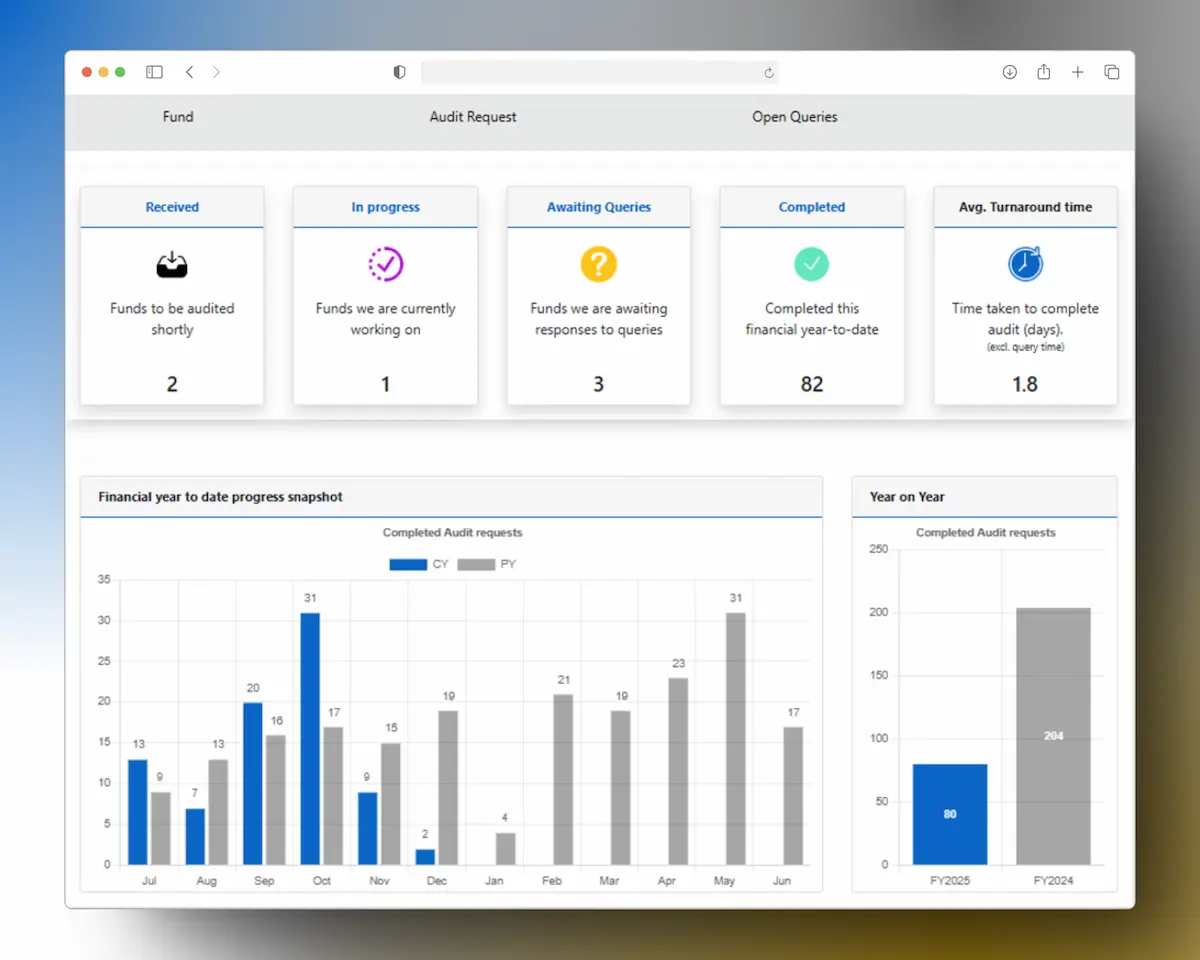

- Monitor audit progress in real time via your personalised portal and dashboard

- Collaborate with our audit team through one central system

Designed specifically for SMSF audits, our platform removes friction from the process, reducing the administrative burden for accountants and advisors – we make it all a joy to work with.